Grogu

GLP-1 Apprentice

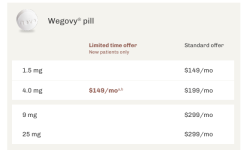

I'm not sure if it's just me, but don't these lower prices for starter doses seem like "teaser rates" and quite frankly shakedowns? Kind of undignified for big pharma intending to get new customers addicted to the product and then charge them significantly more for effective doses....

The pill was supposed to be easier to manufacture and less expensive. These prices are still too high for most americans. I can't imagine that there is any significant incremental cost of making a 25mg pill over a 1.5mg pill.

The pill was supposed to be easier to manufacture and less expensive. These prices are still too high for most americans. I can't imagine that there is any significant incremental cost of making a 25mg pill over a 1.5mg pill.